Top 30 Forex Brokers - Questions

Top 30 Forex Brokers - Questions

Blog Article

Top 30 Forex Brokers Things To Know Before You Buy

Table of ContentsThe Basic Principles Of Top 30 Forex Brokers The Ultimate Guide To Top 30 Forex BrokersGetting My Top 30 Forex Brokers To WorkA Biased View of Top 30 Forex BrokersThe Ultimate Guide To Top 30 Forex BrokersThe Facts About Top 30 Forex Brokers UncoveredTop 30 Forex Brokers Fundamentals Explained

It is estimated that there are around 128 pairs that Foreign exchange traders can pick to join the money trading market. Exness. Below are some prominent significant money pairs: Australian Dollar/US Buck (AUD/USD. FX is taken into consideration to be the finest method for novices to begin their financial investment profession and develop their trading skillsMost Forex platforms give cost-free trial accounts permitting newbies to get a taste of market movement and develop an efficient FX trading strategy. The low capital obstacles, along with no payments on the majority of accounts, are several of the factors that Foreign exchange markets are chosen by a lot of enthusiast in trading

All About Top 30 Forex Brokers

A rookie can go into a resources of $500 and trade with a margin of 1:500. Foreign Exchange has small or no profession commissions in a trading account.

Therefore, there is constantly a potential merchant waiting to acquire or sell making Foreign exchange a liquid market. Rate volatility is just one of the most vital elements that aid decide on the next trading action. For short-term Forex traders, cost volatility is crucial, because it illustrates the per hour adjustments in a property's worth.

Top 30 Forex Brokers - Questions

For long-term investors when they trade Forex, the price volatility of the market is likewise essential. This is why they consider a "purchase and hold" method may supply higher incomes after an extended period. One more considerable benefit of Foreign exchange is hedging that can be applied to your trading account. This is an efficient approach that helps either get rid of or decrease their danger of losses.

The four major directional trading sessions are divided as adhered to: The Sydney Session; The Tokyo Session; The London Session; The New York City Session. In the 24-hour Forex market, traders can start their account relocates when the Sydney Session opens till the close of the New york city Session. Also, professionals that trade Foreign exchange separate their trading into four sessions depending upon the geographical area: Pacific Session (Sydney Session); The Asian Session (Tokyo Session); The European Session (London Session); The North American Session (New York City Session).

The Basic Principles Of Top 30 Forex Brokers

Relying on the time and initiative, traders can be split into groups according to their trading style. A few of them are the following: Foreign exchange trading can be effectively used in any of the approaches above. Moreover, because of the Forex market's great volume and its high liquidity, it's feasible to get in or leave the market any kind of time.

Its decentralized nature needs constant connectivity and flexibility. This is why a wonderful number of programmers are frequently functioning to enhance this modern technology, making Forex trading platforms better for modern money demands. Therefore, technical advancements aid Foreign exchange trading to become much more prevalent since everyone can trade from anywhere in the world.

Top 30 Forex Brokers Fundamentals Explained

Thus, it's possible to begin with any kind of trade dimension. There are 3 kinds: Micro Lot. This kind amounts to 1,000 units of currency. Mini Lot. This equals 10,000 devices of money. Standard Whole lot. This is the biggest lot and equals 100,000 units of currency. The mini great deal is generally made use of by beginners and helps them have a lot more efficient risk management.

Forex trading is a decentralized technology that operates without any central monitoring. That's why it is a lot more susceptible to fraud and various other kinds of risky tasks such as misleading promises, too much high danger degrees, More Bonuses etc. Thus, Foreign exchange regulation was created to establish an honest and moral trading mindset. An international Forex broker need to abide with the standards that are defined by the Forex regulator.

Specialists and beginners protect their funds by transferring them in various other accounts different from the brokers, so the latter can not use foreign cash for their own company. In the list below, you will locate several of the most prominent FX regulatory authorities: Australian Securities and Financial Investment Payment (ASIC); Financial Conduct Authority (FCA); Products and Futures Trading Payment (CFTC); Stocks and Exchange Board of India (SEBI).

What Does Top 30 Forex Brokers Mean?

Therefore, all the purchases can be made from anywhere, and given that it is open 24-hour a day, it can also be done at any moment of the day. For instance, if a financier is located in Europe, he can trade during North America hours and check the relocations of the one currency he wants.

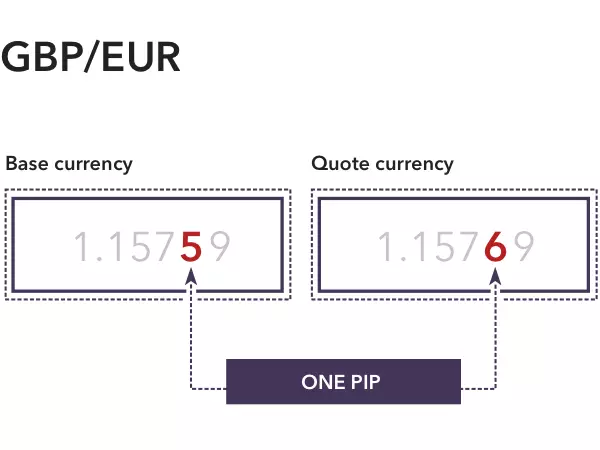

In comparison with the supplies, Forex has really reduced transaction prices. This is because brokers earn their returns with "Details in Portion" (pip). Moreover, a lot of Foreign exchange brokers can use a really low spread and minimize and even get rid of the investor's prices. Investors that choose the Foreign exchange market can increase their revenue by preventing fees from exchanges, deposits, and various other trading activities which have additional retail purchase prices in the stock exchange.

The Buzz on Top 30 Forex Brokers

Report this page